Copper Cathode Price Trends & Analysis 2023

As the bedrock of modern infrastructure and technology, copper remains a crucial barometer for forecasting the health of the global economy. In this metals industry report, we delve into the intricate dynamics of the copper market, showcasing the most recent copper cathode market analysis. Trends suggest a significant trajectory of growth for the copper cathode sector, as it evolves and adapts to the burgeoning demands of an electrified future. Importantly, key market players are capitalizing on advancements in smelting and refining processes, introducing a new era of efficiency and quality in copper production.

The copper price forecast indicates a strong compound annual growth rate (CAGR), painting a robust outlook for the metal through 2031. As we navigate through the competitive landscapes of the United States, Europe, and Asia-Pacific markets, this analysis provides an in-depth view of the forces propelling the market forward. Join us as we explore the far-reaching implications of these copper market trends and prepare for a future where copper continues to power innovation and economic growth.

Introduction To The Current Copper Cathode Market

The global copper market is witnessing a substantial uptick, exemplified by the predicted compound annual growth rate (CAGR) spanning from 2022 to 2029. This period is poised to unfold as one of substantial copper cathode industry growth, propelled by factors such as technological innovations and the strategic presence of established market players.

Renowned for its conductive properties, copper remains a staple in the development and maintenance of modern infrastructure. In the United States, the copper market continues to be vital and vigilant to the fluctuations that feed into the broader global copper market. Indeed, shifts in the U.S. market reverberate across the global stage, influencing the trajectory of the entire copper cathode industry. North America, alongside Europe, showcases remarkable growth rates, underscoring the regions’ significance to this sector’s expansion.

To grasp the contemporary dynamics shaping this market, one must consider several pivotal aspects, namely:

- Accelerating copper consumption trends due to burgeoning technological applications

- The symbiotic evolution of advanced technology alongside copper cathode production improvements

- A nuanced comprehension of market stratification, detailed through categorizations such as manufacturer, region, type, and application

Such a comprehensive overview forms the foundation of our understanding, allowing stakeholders to navigate the complexities and seize opportunities within the ever-evolving landscape of the copper cathode market.

Overview Of Copper Cathode Application Sectors

Copper’s versatility and superior conductive properties have made it an invaluable resource across several key industries. Its robustness and reliability support not only foundational infrastructures but also pave the way for innovative advancements in technology and sustainable energy solutions. From ensuring the functionality of modern homes to driving the latest developments in green technology, copper’s role is multifaceted and indispensable.

Construction Industry’s Influence On Copper Demand

The construction sector remains a cornerstone of copper in construction demand, where it plays a critical role in both residential and commercial projects. Its applications span electrical wiring systems, plumbing, heating and cooling systems, and architectural elements, confirming copper’s status as a staple in the industry. The rise in global urbanization, bolstered by an expanding population, directly correlates with increased copper utilization.

Electronics And Automotive Industries As Key Consumers

With the ever-growing consumer appetite for electronic devices and advancements in automotive technology, copper has seen a surge in demand within these markets. The electronics and automotive copper use has skyrocketed, owing to copper’s superior electrical conductivity which is essential for the efficient operation of vehicles and the reliability of electronic gadgets. From circuit boards to battery systems, copper is the backbone of an array of electronic components and automotive applications.

- In-car entertainment and navigation systems

- Electric vehicle power systems

- Consumer electronics such as smartphones and tablets

Role In Renewable Energy Advancements

The urgent shift towards clean, renewable sources of energy has significantly increased the renewable energy copper demands. Copper is a critical element in solar, wind, and hydroelectric power generation systems. With an enhanced focus on reducing carbon footprints and a global push towards sustainability, the significant role of copper in renewable energy infrastructure becomes ever more pronounced, particularly in solar panels and wind turbines, which require substantial amounts of the metal for optimum functionality. Additionally, the burgeoning electric vehicle (EV) sector heavily relies on copper to power a greener future.

- Wind farms and their high-intensity copper components

- Solar energy systems and copper’s conductive contribution

- Electric vehicles and the increasing copper-centric designs

Global Copper Cathode Market Manufacturers

The global landscape of the cathode copper market leaders is a prominent facet of the metals industry, shaped by the expertise and production capabilities of several major copper producers. Entities such as JX Holdings, Freeport McMoran, and Codelco have cemented their positions as top copper cathode manufacturers, successfully balancing the increasing demands with a sustained supply of high-quality copper.

Efficient and technology-driven production processes are at the heart of these manufacturers’ operations. With a focus on innovation, companies like Tongling, Glencore Xstrata, and Sumitomo are consistently improving their smelting and refining techniques. Their commitments to producing both standard and high-quality copper cathode underscore their status as market leaders within this sector. The dedication to quality by Aurubis, Jiangxi Copper Company, BHP Billiton, and Southern Copper is essential for maintaining the copper cathode market’s integrity and reliability.

Understanding the implications of copper cathode production trends is essential for stakeholders within the electronic products and construction sectors, where the application of copper is critical to product performance. Below is a comprehensive list of the key players that dominate the global copper cathode market:

- JX Holdings

- Freeport McMoran

- Codelco

- Tongling

- Glencore Xstrata

- Sumitomo

- Aurubis

- Jiangxi Copper Company

- BHP Billiton

- Southern Copper

Regional Analysis Of Copper Cathode Demand

As we delve into the intricacies of the global copper cathode market, it’s evident that the demand across regions is experiencing unique trends and shifts. These patterns underscore the importance of copper cathodes in the development and technological progression of various areas worldwide.

North America And Europe’s Market Dynamics

The markets in North America, particularly with the United States leading the charge, have demonstrated consistent growth and a strong appetite for copper cathode. Notwithstanding the established industrious framework, demand is driven by innovations and infrastructural advancements. Europe, with its influential markets mainly in Germany, France, and the UK, reflects an upward trajectory mirrored by significant compounded annual growth rates (CAGR), indicating a robust endorsement of copper cathode in both traditional and renewable energy sectors.

Asia-Pacific Leading The Consumption Charge

As industry analysts closely watch the Asia-Pacific region, it continues to spearhead the global copper cathode consumption. The economies of China, Japan, India, and Southeast Asian nations demonstrate voracious demand linked to rapid industrialization and substantial infrastructure investments. This area marks a pivotal turn in defining the Asia-Pacific copper market landscape, cementing its position as a major player within the metal’s geopolitics and trading complexities.

Emergent Demand From Middle-East And Africa

The projection of copper cathode demand in regions extends to the emergent markets of the Middle-East and Africa. These areas are marking their presence felt as burgeoning end-users due to urbanization trends, a growing manufacturing base, and a stride towards economic diversification. The scope of copper cathode usage in these regions paints a picture of potential and diversification in global market dynamics. With a swell in infrastructural and technological developments, the Middle-East and Africa join the ranks of burgeoning markets for copper cathode, hinting at a future proliferation in demand.

In totality, understanding the regional copper demands signifies not just the symbiotic relation between copper cathode supply and technological advancements but also underscores the intricacies involved in the North America and Europe copper trends. These insights are vital for stakeholders who require a granular understanding of the market to navigate the future landscape of the copper industry.

Production Process And Quality Levels Of Copper Cathodes

The cornerstone of the metals industry, copper cathode production process, is characterized by a methodical two-stage approach: a robust smelting phase followed by a meticulous electric refining step. It is through these stages that copper ore is transformed into high-purity cathode copper—meeting and often exceeding the rigorous cathode copper purity standards. The end product, utilized in a multitude of applications, boasts an exceptional 99.95% purity level, a testament to the efficacy of current copper refining techniques.

Technological innovation has been a game-changer for the industry. It has not only streamlined the entire production cycle but has also played a pivotal role in significantly reducing operational costs. Modern advancements have paved the way for sophisticated methodologies, such as advanced electrolytic refining techniques, which optimize the purification process.

- Initiation of the smelting process, in which raw ore undergoes thermal processing to extract the base metal.

- Implementation of electrolytic refining, a key phase where impurities are isolated from the resultant metal to ensure product excellence.

- Finalization of the cathode creation, resulting in copper that meets global standards for electrical conductivity and durability.

Recognizing the delineation between smelting and refining is crucial. While smelting combines heat and chemical reducing agents to decompose ore, drive off other elements as gases or slag (waste), and leave just the metal behind, the refining process takes the smelted metal and through an electrochemical procedure, strips away any lingering impurities, yielding copper cathodes of unsurpassed purity.

It is these processes and methodologies that underpin the robust framework for copper cathode manufacturing, aligning quality with excellence. As such, the industry continues to meet the high demand for copper, not only in volume but also in unmatched quality.

Analysis Of Copper Cathode Price Fluctuations

The landscape of copper price volatility is everchanging, making it a critical metric for stakeholders across various industries. Understanding the market trends in copper pricing helps in navigating the economic hurdles and capitalizing on potential investment opportunities. In this analysis, we’ll delve into the factors affecting copper prices and how they contribute to the ebbs and flows of this valuable commodity’s cost.

Economic indicators significantly impact copper prices. Interest rates, tied closely to economic growth, often dictate investment in commodities like copper. A strong economy typically translates into robust manufacturing and construction sectors, driving up the demand for copper. Conversely, economic downturns can dampen that demand, leading to lower prices.

Political stability is another factor to consider. Regions abundant with copper reserves often face geopolitical tensions that can disrupt mining operations and affect global supply. Moreover, copper’s use in infrastructure and technological advancements means that any shifts in government policies related to these areas can influence pricing.

The US dollar rate plays a quintessential role in commodity pricing internationally. Copper, traded in dollars, becomes cheaper for foreign investors when the dollar weakens and more expensive when it strengthens. Oil price volatility can also translate to changes in copper prices due to the metal’s substantial energy requirements during mining and refining processes.

- Technological innovations introducing more cost-efficient mining techniques can reduce production costs.

- The introduction of substitutes, such as aluminum and fiber optics, challenge copper’s hegemony in its primary markets.

- The growing \”green\” economy fosters novel uses for copper, particularly in electric vehicles and renewable energy sectors.

Finally, China’s influence on the copper market cannot be overstated. As the largest consumer of copper, China’s industrial activity and economic health have an outsize effect on worldwide copper pricing. Shifts in this nation’s consumption patterns send ripples through the global market.

Understanding these dynamics is crucial for market participants to adjust their strategies accordingly. In the next section, we will continue by looking closer at copper price trends historically versus the present scenario.

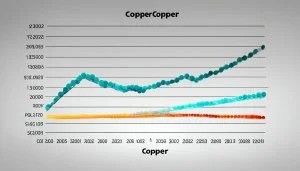

Copper Cathode Price Trends: Historical Vs. Present Scenario

Examining the journey of copper cathode prices offers an insightful narrative on how the metal market has evolved. As we navigate through the labyrinth of economic factors that have charted the course of copper prices, it is imperative to understand the historical copper prices alongside current copper price trends. Such analysis helps stakeholders and investors steer through the commodity market’s complex influence on copper.

Pricing Impact Of Production Shifts

The historical landscape of copper prices has witnessed dramatic shifts aligned closely with production trends. Market agility reflects changes from geopolitical developments to technological advancements, all of which contribute to the global availability and consequent pricing schema for copper cathodes. Disruptions in mining activities or shifts towards more efficient production methods have had measurable impacts on the pricing dynamics.

Commodity Market Swings And Copper Pricing

The volatile dance of copper pricing is often led by the tune of the greater commodity market’s influence on copper. Factors such as trade policies, speculative trading, and changes in demand patterns have historically triggered swift responses in copper prices. Presently, markets remain vigilantly attuned to the rhythms of the London Metal Exchange and speculative investment flows, which together weave the intricate pattern of current copper price trends.

Economic Policies Influencing Raw Material Costs

Economic policies, on both macro and micro scales, act as pivotal modulators for raw material costs, including copper. Policies that influence production costs, international trade tariffs, or those that regulate mining licenses all play their part in sculpting the cost of copper cathodes. Present scenario analysis underscores the growing importance of national economic strategies and their role in shaping the cost structures associated with copper production and trading.

Technological Innovations Redefining Market Dynamics

Recent advancements in copper production technology have dramatically shifted the landscape of the metal industry, introducing unprecedented efficiency and quality in copper cathode production. Among such innovations, electrolytic refining advancements represent a formidable leap forward, significantly refining the process of copper cathode manufacturing. High standards of purity, critical in sensitive applications, are now achievable thanks to these advancements.

Key developments in metal industry innovation have not only streamlined production but also reduced the environmental impact, a paramount concern in modern manufacturing. The introduction of these technologies facilitates the production of copper that aligns with the rigorous quality expectations of industries such as electronics, where copper’s superior conductivity is essential.

- Innovative electrolytic cells improve yield and purity.

- Automated systems enhance consistency and reduce human error.

- And cutting-edge smelting processes minimize environmental footprint.

The advancements in technology are not just limited to refining processes. They encapsulate a holistic improvement across all facets of production—right from extraction to the final delivery of high-grade copper cathodes. These technological leaps are drivers of growth, setting a precedent for future innovation in the metal industry.

Key Factors Driving The Supple And Demand For Copper Cathode

Understanding the ebbs and flows within the copper cathode market requires an in-depth look at the various factors that drive both supply and demand of this essential metal. The growth trajectories are closely tied to widespread urbanization, escalating consumer electronics production, and ever-tightening environmental regulations, all of which contribute to the intricate dynamics of the copper cathode industry.

Effect Of Urbanization On Copper Consumption

The rapid urbanization witnessed across the globe serves as a robust engine propelling the demand for copper cathode. As cities expand and infrastructure requirements multiply, copper’s role in electrical, transportation, and telecommunication systems becomes increasingly indispensable. Urban development sparks growth in the construction sector, leading to a surge in the use of copper cathode for the fabrication of electrical wiring and plumbing components.

Advancements In Consumer Electronics Uptake

The surge in consumer electronics demand for copper mirrors the sector’s rapid expansion. New-age gadgets, modern computing devices, and telecommunications infrastructure rely heavily on the superior electrical conductivity of copper cathodes. The unflagging pace of innovation within consumer electronics not only fuels extensive copper usage but also champions consistent quality enhancements to meet the market’s rigorous performance criteria.

Environmental Regulations Shaping Metal Use

Regulatory frameworks targeting sustainability and responsible resource use impose a significant effect on the copper cathode market. Stringent environmental regulations incentivize the adoption of recycling programs and thrust high-purity copper standards to the forefront of production protocols. The resultant drive towards ample utilization of recycled materials further buttresses the copper cathode market drivers, underscoring copper’s versatility and reaffirming its position in green policy developments.

Copper Cathode Price Projection For 2023

As the new year unfolds, the copper cathode price forecast takes center stage for investors and industry analysts alike. With a significant presence in industrial applications and technological innovations, copper remains a benchmark for market stability and growth potential. For 2023, the trends indicate a dynamic pricing landscape governed by robust demand and evolving international market conditions.

Analyst Insights And Market Forecasts

Expert analysis projects the copper cathode price forecast that could see averages around $8,596 per metric ton. The consensus among specialists suggests a trajectory influenced by sustainable demand across crucial industries, such as construction and renewable energy. These sectors’ continuous expansion and reliance on high-quality copper cathodes solidify the metal’s pricing matrix within the marketplace.

Comparative Study With Other Base Metals

In comparison to other base metals, copper’s utility and efficiency in various applications such as electrical components and green technologies bolster its value. While alternatives exist, the intrinsic properties of copper cathodes place them in a unique category of demand, reinforcing the market predictions of a bullish price outlook.

Investment Outlook In Copper Assets

The investment trends in copper skew towards optimism due to its indispensable role in supporting the infrastructure of tomorrow. Driven by the uptick in electric vehicle production and sustainable energy projects, investors recognizant of copper’s tangible benefits are positioning their portfolios to capitalize on its projected valuation growth, maintaining a spirited influx of capital into copper-centric ventures.

Conclusion

As the calendar flips to new pages, the copper cathode market stands robust, poised for an impressive trajectory of growth. This market expansion is fueled by a confluence of impactful drivers: the steady march of technological progress, a burgeoning appetite across pivotal sectors such as construction, electronics, and automotive, and the green tailwinds provided by renewable energy initiatives. Furthermore, ever-shifting environmental regulations are propelling changes in both production and consumption patterns within the industry.

In a comprehensive view that spans continents, North America and Europe maintain their significance in the global theater, steadfastly contributing to market dynamics. Yet, it’s the Asia-Pacific region that dominates conversations about consumption, powerfully leading the demand. At the heart of production lies an unwavering commitment to excellence — a commitment that is evidenced in the high purity levels achieved through refined, innovative metallurgic processes. However, it’s not all smooth sailing; the market does witness price trend insights zigzagging in response to the ebb and flow of macroeconomic forces and geopolitical turns.

But in this complex web of variables, one constant remains — the future copper industry perspective looks vibrant. Optimism is undergirded by expert market forecasts for 2023, casting copper in its perennial role as a linchpin metal of civilization. Opportunities beckon in the investment horizon, as copper assets continue to allure with their intrinsic and strategic value. In essence, as we forge ahead, the copper cathode market summary crystalizes into a narrative of resilience, innovation, and unending relevance.

FAQ

What Is Driving The Copper Cathode Market Growth?

Market growth is driven by increased adoption of advanced technologies, growing demand from the construction, electronics, automotive, and renewable energy sectors, and evolving environmental regulations.

Which Regions Are Leading In Copper Cathode Consumption?

The Asia-Pacific region leads global consumption, followed by strong demand in North America and Europe, with emerging markets in the Middle East and Africa also contributing to demand.

Who Are The Top Manufacturers In The Global Copper Cathode Market?

Key global manufacturers include JX Holdings, Freeport McMoran, Codelco, Tongling, Glencore Xstrata, Sumitomo, Aurubis, Jiangxi Copper Company, BHP Billiton, and Southern Copper.

How Does Urbanization Affect Copper Consumption?

Urbanization impacts copper consumption by driving the demand for residential and commercial infrastructure development, leading to increased usage of copper in electrical and plumbing systems.

How Are Technological Innovations Impacting The Copper Cathode Market?

Technological innovations, such as advanced electrolytic refining, are redefining the market dynamics by improving production efficiency and quality, which in turn drive demand and growth in the market.

What Factors Contribute To Copper Cathode Price Fluctuations?

Copper cathode prices are influenced by a variety of factors including interest rates, economic growth, market demand, political considerations, and technological advancements.

What Is The Forecasted Average Price For Copper In 2023?

The forecasted average price for copper is projected to be around ,596 per metric ton in 2023, with strong demand from key sectors sustaining a steady price outlook.

How Do Environmental Regulations Impact The Copper Cathode Market?

Stringent environmental regulations encourage the use of recycled metals and high production standards, shaping how copper cathodes are produced and used across various industries.

What Is The Role Of Copper In Renewable Energy Advancements?

Copper plays an essential role in renewable energy advancements due to its use in solar power installations, wind energy infrastructure, and the electric vehicle sector, all of which require high-purity copper for efficient operation.

How Do The Electronics And Automotive Industries Impact Copper Demand?

The electronics and automotive industries are key consumers of copper, utilizing its excellent conductivity properties for automobile production and manufacturing various electronic products.

Why Is Asia-Pacific Leading The Charge In Copper Cathode Consumption?

The Asia-Pacific region leads due to its rapid industrialization, infrastructure expansion, and the dynamic markets of countries like China, Japan, Korea, India, Australia, and Southeast Asia.

What Is The Expected Compound Annual Growth Rate (CAGR) For The Copper Cathode Market From 2023 To 2031?

The copper cathode market is predicted to experience a strong Compound Annual Growth Rate (CAGR), indicating significant growth potential during the period from 2023 to 2031.

How Do Commodity Market Swings Influence Copper Pricing?

Commodity market swings affect copper pricing through changes in supply and demand dynamics, inventory levels at exchanges like the London Metal Exchange, and broader macroeconomic conditions.

What Part Does The United States Play In The Global Copper Cathode Market?

The United States is pivotal in the development of the North American market, and changes in its market have the potential to significantly influence the global copper cathode industry.